Due Diligence

Overview

As is well known that legal due diligence is the pioneer step to be taken by any investor entering into any transaction.It aids in assessing the risks relating to any business transaction relating to takeover, M&A, asset reconstruction, forming and retaining joint venture or Special Purpose Vehicle (SPV) or entering into PPP partnership, Foreign Direct Investment, etc. The scope of this Due Diligence includes:

- Research on the credentials of the target company or its business activities,

- Review of the Statutory Books maintained by the Company

- Ongoing and past Litigations pertaining to the target Company or any particular Project for assessing its legal viability and bankability of the ongoing and prospective projects

- Material contracts

- Related party transaction

- Governmental reports pertaining to the target company or the property, etc.

- Housing or Commercial Projects

- Technology related projects

After collating and analysing the aforementioned, a due diligence report is prepared for final assessment of whether to enter into any transaction or not, understand the risks, allocate the risks, etc.

Insights

-

Analysis on judicial review in the public procurement process

JUDICIAL REVIEW OF PUBLIC PROCUREMENT PROCESS INTRODUCTION The pillar of a fair, just and impartial government and/or administrative action is based on the judicial review. Judiciary through its power of scrutiny enquire about the legality of the action done by the Government body which included creating checks and balances qua the decision taken by any public authority... -

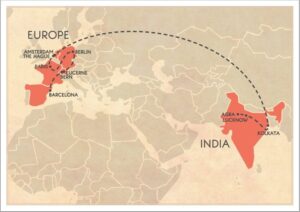

Title: Strengthening Bonds: Inter-Se Trade and Commerce between Europe and India

Introduction: The global landscape is witnessing a remarkable shift in trade dynamics, as inter-se trade and commerce between Europe and India present unprecedented opportunities. This burgeoning relationship has the potential to transform the world, benefiting the organizations involved and paving the way for a robust partnership. In this blog, we will explore the immense advantages...

Start-up and Entrepreneurship Consultancy

Alternate Dispute Resolution Solutions

White-Collar and Corporate Crimes

Risk assessment and mitigation

Contract Management solutions

Policy Advisory and Advocacy

Investment consultancy NRI’s, FDI,Private Equity & Venture Capital

Project Management Consultancy & Legal Advisory on turnkey basis

Comprehensive Litigation

Corporate advisory & regulatory framework