TAX SERIES:CHAPTER 2: INDIA AS A DIGITAL ECONOMY

CHAPTER 2: INDIA AS A DIGITAL ECONOMY

INTRODUCTION

As Bill Gates had mentioned once “if your business is not on the Internet, then your business will be out of business” made world realised the importance and convenience of internet. India is one of an emerging country and needs to fulfil its socio-economic goals with the governance of its government. Quick developments in Information and communication technologies led the way to modified economy, known as digital economy. According to the development of the nation and the tech team, it was declared that India’s digital economy is capable to hold up to $4 trillion in four years, however it was assumed before pandemic occurred due to covid-19. Because of digitalisation, India becomes the second largest market economy for smartphones in the world. Government constantly providing schemes to fulfil its aims to make India digital worth $1 trillion by 2022 from around $450 billion at present. India has become a major actor in global economy and a key member in Organisation for Economic Co-operation and Development (OECD). Digitalisation is changing aspects of lives and society too. India is considered to be an attractive market for entrepreneurs globally. To start with any business, tax is the most important perspective to keep in mind. Indian tax revenue came out to be low because of which government has been thinking about digital taxation from a long time after losing tax from tech and multinational companies. Thus, to examine the challenges in an Indian digital economy lets first understand how India has progressed, developed and improved as a digital economy.

STEPS TOWARDS DIGITALISATION

Since the industrial revolution, internet is considered to be a technological revolution of the nineteenth and twentieth century. Simultaneously, growth and awareness of internet was spreading amongst people as a medium for conducting many personal and business activities. The way of engaging business is not exactly same like a traditional way of doing business. As an emerging global economy, e-commerce and e-business have constantly participated as an essential component of business strategy and a strong catalyst for economic development. The integration of Information and Communications Technology (ICT) in business has modified relationships within organizations and also between and among organizations and individuals to improve and support the economy.

In 2015, Prime Minister of India Mr. Narendra Modi launched a programme called Digital India- Power to Empower. Aim of this programme is to develop India into an informed economy and a digitally empowered society. This programme was launched to provide India with cashless or paperless economy, to be more transparent and progressive. To smoothen its functioning India is trying to formulate a regulatory framework for each sector to strengthen its emerging digital economy. Skill and access are the elements for this revolution to establish digital economy. On July 1 2020, Ministry of Electronics and Information Technology has shared its journey of five years of being digital. Sole purpose was to provide digital services in each corner of India and to grow and develop the nation. Some of the initiatives India succeeded in five years under the programme are as follows: –

Digital identity – India developed a national identity system called Aadhar Card. It has considered the world’s largest biometric ID project. It consists of a unique and randomly generated of 12 digits with photographed face along with fingerprints and iris scanned to ensure no duplicates and for the protection of the database. Aadhar card is the first “foundational ID” issued by the government of India. Every month new aadhar card has been issued and the calculation has reached up to 1.21 billion. More initiatives and progressions have started namely in digital governance, digital platforms, digital payments, Digital Infrastructure, Digital Inclusion, Digital Industry, Digital policy Initiatives, Digital Start-ups, Digital Healthcare, Digital Agriculture, Digital Education, Digital Literacy, Digital Skilling, Digital Services, Digital Securities, Digital employment, Digital democracy and some Covid ICT based initiatives have also been taken.

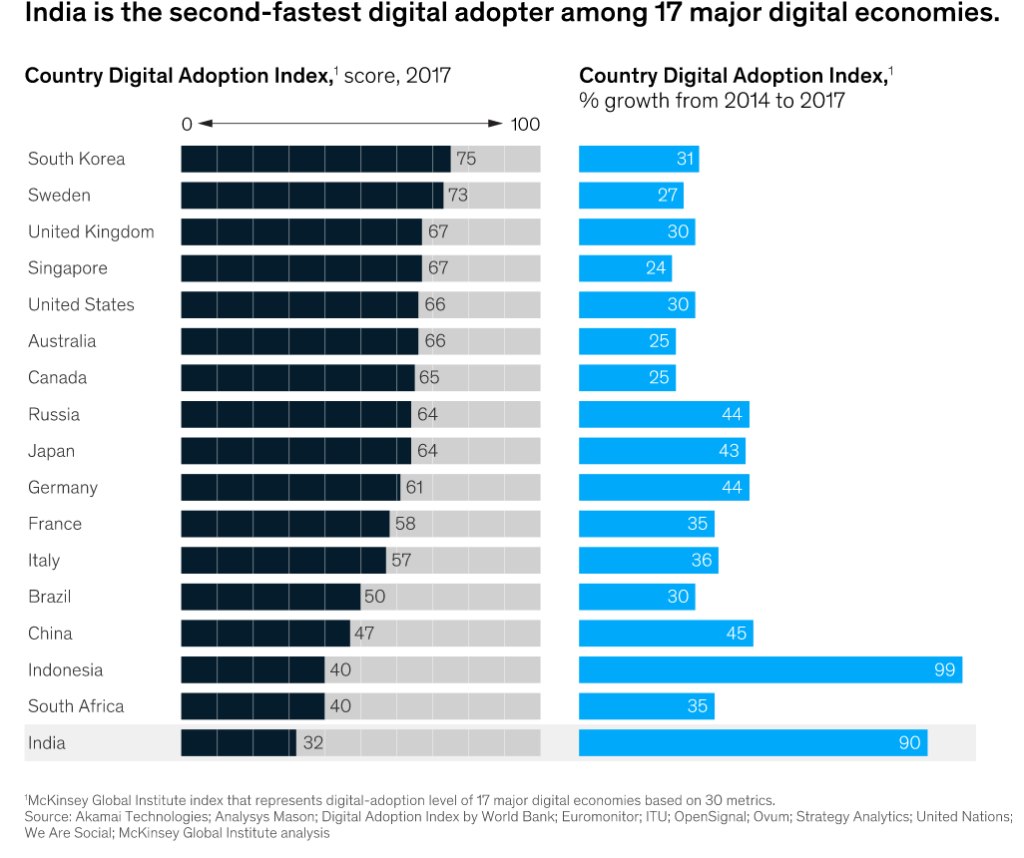

Considering the fact that rural population in India is 66% of the total population calculated in the year 2019 which implies that more than half of its population lives in countryside or villages. For this population, common service centres (CSC) scheme was made under the digital India project. This scheme helps in delivery of vital public utility services, social welfare schemes, healthcare, financial, education and agriculture services in rural and remote areas of the country. It is a pan-India link to diversified nature of the country. For further development, Common services centre (CSC) has signed memorandum of undertaking with Axis bank to ensure banking facilities in rural India[1]. India is giving access to every facility and providing an infrastructure for the economy to become digitalised. Data is power. The idea about digital infrastructure should be a public good is the first guiding principle of the Indian approach to the Internet, the second is that people should be empowered by data. In its progress report, Ravi Shankar the Law Minister of India said that India is now on top two countries all over the world undertaking many digital adoptions.

India’s Digital Adoption Index has risen enormously. Digital Adoption Index includes three elements: Digital foundation, digital reach and digital value. India’s score increased by 90 percent as shown above.

However, digital economy offers growth, profit and development to people and companies around the globe. On the same time, it has introduced with significant problems too mainly under the taxation sector. India is considered to be a global IT powerhouse but half of its population could not be benefitted by digital economy because of its infrastructure maybe. As found two in five Indian business have an appearance on Internet. Point to be noted that rural population in India is 66% of the total population in year 2019. They are still getting used to internet-based services government is providing in it schemes and campaigns. Adopting digital technologies shows good changes in the country, comparatively higher for government than for business.

FEATURES OF DIGITAL ECONOMY

Because of globalisation, small business got an opportunity to enter global market at a very less cost. This means it is a structure which is recognised as borderless trade. To support its digital economy, India has to provide economical access of Internet, workers training in new skills and implement regulations to ensure competition. Billions of people have no internet access therefore lacking in services provided by being digital. The gap between technological development and legal have promoted legal uncertainties. Moreover, digital economy helps regional businesses to enter globally instead of restricting themselves to local jurisdiction. Not all countries can take full benefits from digital economy. Substantially everything is online which brings us to issues related to trust, privacy, and transparency. However, despite many opportunities entrusted by the digital economy, India has not yet fully perceived the potential of harnessing digital technology for sustainable development, due to poor ICT infrastructure, inadequate skills development, and socioeconomic barriers that backed off much of India’s population from utilizing the features of the digital economy. It is been observed that digital transformation does not include only data and digital platforms but also how advanced technologies can be capitalized enough to support innovation, business models and processes, digital services. Hereafter, we would study about business models introduced and are potentially in use by the citizens of India.

PLATFORMS

Digital platforms are modifying the way business were conducted to create value for the society. For a business transaction to take place, a technological solution has to be in place. This is supported by a “platform”. A platform is a product, service or system making a tech environment that permits various types of users and complementary business partners to interact. These platforms are also used by policy makers and government to provide income and employment opportunities. Business partners are known as complementors. Each day more and more companies are following application ideas that allow any interaction and transaction of business. Companies like Facebook, Amazon, Skype, Google maps, Paypal, Air Bnb, uber and many more companies have adopted this business model either to conduct their business or provide services digitally. It is been observed that Indians download applications more than the resident country, approximately 19 billion apps were downloaded in the year 2019 which results in 195% of growth than 2016. These companies provided a platform to sell their products or services to people. Digital economy has led to the formulation of various innovative business models. Through the report it has been said that YouTube and Facebook are the most popular social media networks in India. Also, Amazon and Flipkart are famous for online shopping and TikTok was the most downloaded app in 2019.There are 290 million users active on Internet. Considering the number of users on social media to this extent imagine the level of e-commerce transactions in India. There is absolutely no doubt that why foreign companies are interested in engaging with Indian market.

E-COMMERCE

E-commerce is a new way of contractual relationship between a buyer and seller without having no physical contact. E-commerce stands for electronic commerce. In other words, a person can buy or sell anything while sitting at home. Transactions are conducted worldwide between parties living in different jurisdictions which led to massive cross border transactions. Unlike traditional way it saves time and energy and is trending in India. Moreover, it is a range of internet business activities used for products and services. E-commerce is a part of e-business. But taxing authorities are facing challenges in taxation matters. Online business transactions, also known as E-commerce provides convenience to people including customers and corporations. E-commerce also helps retailers to expand their business without any capital-intensive physical stores. Therefore, resulting in more and more usage of platforms for buying and selling by their websites or by contracting with the third-party sites like Amazon which provides them a larger audience along with all facilities including payment services, logistics and delivery. Many small and medium size entities now involved themselves in cross border transactions that results them to face international tax regimes. E-commerce makes traditional concepts like permanent establishment (to determine place of manufacturing), place of sale (for the liability of relevant tax rates), income classification (based on source of income), product classification (for preferred tax) are difficult to be levied.

CHALLENGES IN E-COMMERCE

The revolution in which digital economy is a boom to the globe, it has changed the pace and growth of our lives. Giving more and more opportunities as well as intimidating challenges. Considering the fact that Internet is intangible, taxing e-commerce is daunting as data is vast and intangible and networks are coming from all over the world. Because of advancement in technology, state is challenged with a mammoth categorised into internet and cyberspace. Therefore, having monetary control over cyberspace will help government to raise some amount as usually taxes are collected at the end of sale. Absence of boundaries and any physical transaction in e-commerce related to goods and services some taxation issues tend to arise. For instance, a book can be on database accessible online and also can be downloaded as an e-book. Such income is blurred between trade income and service income which needed to be classified in e-commerce transactions.

According to the author, to provide legality to an e-commerce various laws like IT laws, cyberlaws, taxation laws, company laws are subjected to work together. Amendment in one branch of law should maintain harmony with other branches as well for a smooth transformation.

IMPLEMENTAION OF TAXATION LAW IN INDIA

Taxes are money of the government for the welfare of the general public and for the development of its economy. Government of India levies taxes comprising of two types- direct and indirect taxes in which corporate income tax is to be considered as a main source of tax revenue in India also the highest contributor to direct taxes. On the other hand, consumption taxes are liable according to the principle of taxation at the place of consumption and secondly the rates are set in respective country or individual states. In India, consumption taxes like Value added Tax, Sales Tax, Excise Tax were replaced by one tax called Goods and Services Tax (GST) in 2016. National government care about international tax as it effects its foreign investment and revenue base.

Tax embezzlement is a criminal offence. And it can be exercised by any person whether corporate or natural. In this paper, the most important perspective to be considered that not only our economy should improve but our ancient laws should also amend, change and develop with time, technology and with behaviour of the society. One example is of multinational corporations (MNCs) or businesses conducting business in different jurisdictions. Their economic activities being based in multiple jurisdictions are liable to be taxed but concepts like double taxation or principle of clarity in law comes into picture. Concept of permanent establishment is an important concept in double taxation treaty law. However, multinational corporations taking advantage of the gap between domestic taxation laws and international laws tends to avoid tax. To be more clear tax avoidance is prevention of a tax obligation from arising in a first place and was founded legitimate. Lord Templeman said thus ‘there is no morality in a tax and no illegality or immorality in a tax avoidance scheme. Whereas tax evasion is illegitimate and is considered to be fraud. The international tax system needs a permanent resident for direct tax which is impossible in selling of goods or services in a digital economy. As, it works without any physical presence. Taking advantage of the abovementioned problem enterprises constantly tries to minimise their tax liabilities by establishing their legal or business centres or transferring their profits from a high rate to zero rate or no tax rate jurisdiction. Situation discussed above is termed as Basic Erosion and Profit Shifting. The concept of taxation includes jurisdiction, which we see from “Boston Tea party rebellion” as tea was taxed just because it landed on American shores. As taxation plays an important role in economic policies. Perhaps, new rules and concepts have to be proposed and implemented. To achieve sustainable Development Goals and overcome the problems, OECD has focused on Base Erosion and Profit Shifting and also provide with its Action plans as explained in chapter 4. E-commerce has a probability of undermining applicability of national and international tax rules.

CONCLUSION

Indian government has done much to encourage digital progress, from rationalizing regulations to improving infrastructure to launching Digital India. An absolute driven initiative to make the size of the country’s digital economy twice. However, lot of steps have to be taken for India to realize its full potential. From a tax perspective, development in digital economy has resulted in non-resident companies engaging in market jurisdictions structurally different than at the time international tax rules were created. Thus, we know that growth of digital economy and loopholes in law have led MNCs to avoid taxes by aggressive tax planning resulting in for new or amended rules for international tax regime which is to discussed in next chapter. Given that tax is about money. The issue is the extent to which those development of digital economy will involve tax avoidance. To work out the plan properly, government has to formulate new strategies to support growth. However, legal tax comprises a proportion in Gross Domestic Product (GDP) of India. Thus, it is mandatory for authorities to refine appropriate rules. Taxing forums are likely to improve the administration and infrastructure of tax policies for unconfined problems arising in e-commerce transactions. But first we need to discuss the challenges government tends to face in taxing e-business.

Contributed by – Ujjwala Gupta, Senior Legal Counsel, SUO Law Offices